UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(RULE 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant x Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

Host Hotels & Resorts, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of person(s) filing proxy statement, if other than the registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which the transaction applies: |

| (2) | Aggregate number of securities to which the transaction applies: |

| (3) | Per unit price or other underlying value of the transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of the transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

April 1, 201010, 2013

Dear Fellow Stockholder:

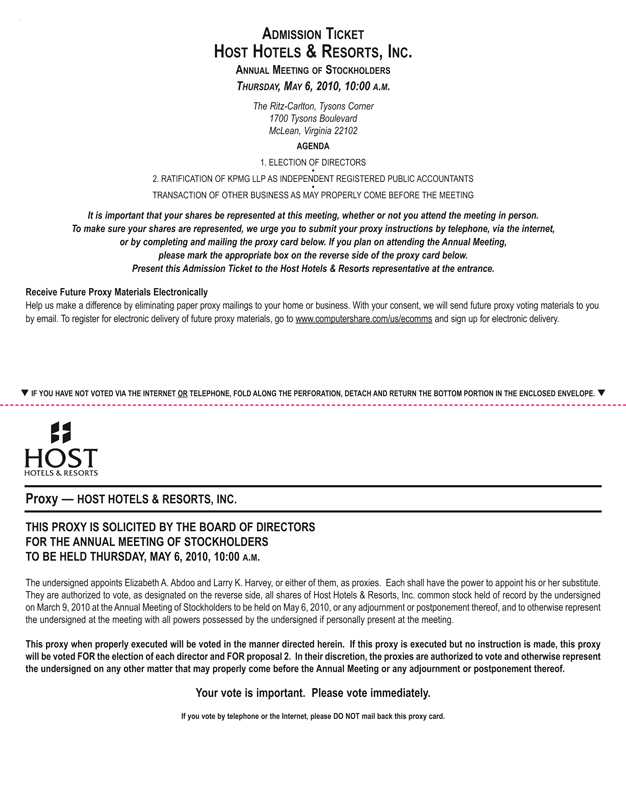

I am pleased to invite you to our 20102013 Annual Meeting of Stockholders of Host Hotels & Resorts, Inc., which will be held at 10:00 a.m. EDT on Thursday, May 6, 2010,16, 2013, at The Ritz-Carlton, Tysons Corner in McLean, Virginia. The doors will open at 9:30 a.m. EDT. Our directors and management team will be available to answer questions.

The attendance of stockholders at our annual meetingsmeeting is helpful in maintaining communication and understanding.understanding of our business. We hope you will be able to join us. Whether or not you plan to attend, it is important that your shares be represented and voted at the meeting. Youyou can ensure that your shares are represented at the meeting by promptly voting over the Internet,and submitting your proxy by telephone or by using a traditionalInternet, or by completing, signing, dating and returning your proxy card.form. Instructions for these convenient ways to vote are set forth on the enclosed proxy card. If you attend the meeting, you may continue to have your shares voted as instructed in the proxy or you may withdraw your proxy at the meeting and vote your shares in person.

We describe in detail the actions we expectproposals to takebe introduced at the annual meeting in the attached Notice of 20102013 Annual Meeting of Stockholders and Proxy Statement. Our 20092012 Annual Report (including our Annual Report on Form 10-K for the year ended December 31, 2012 filed with the Securities and Exchange Commission) is also enclosed. We encourage you to read our 2012 Annual Report and hope you will find it interesting and useful. Thank you for your continued interest in Host Hotels & Resorts, and we look forward to seeing you at the meeting.

Sincerely, |

|

| Richard E. Marriott |

| Chairman of the Board |

6903 Rockledge Drive, Suite 1500

Bethesda, Maryland 20817-1109

NOTICE OF 20102013 ANNUAL MEETING OF STOCKHOLDERS

| Meeting Date: | Thursday, May | |

| Meeting Time: | 10:00 a.m. | |

| Location: | The Ritz-Carlton Hotel, Tysons Corner 1700 Tysons Boulevard, McLean, Virginia (see back page for directions) |

Agenda

| 1. | Election of nine directors |

ElectionThe Board recommends that you voteFOR each of eight directors;the director nominees.

| 2. | Ratification of the appointment of KPMG LLP as the Company’s independent registered public accountants for 2013 |

RatificationThe Board recommends that you voteFOR the ratification of the appointment of KPMG LLP asLLP.

| 3. | An advisory resolution to approve executive compensation |

The Board recommends that you voteFOR the Company’s independent registered public accountants to serve for 2010; andadvisory resolution.

| 4. | Transaction of any other business that may be properly brought before the annual meeting or any adjournment or postponement thereof. |

Transaction of any other business that may be properly brought before the annual meeting or any adjournment or postponement thereof.The proxy statement more fully describes these proposals.

Voting

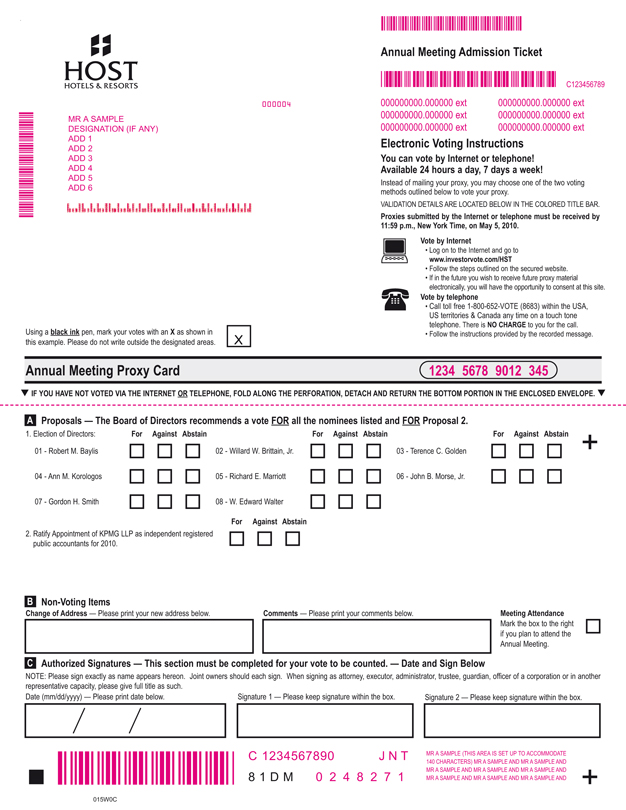

You may vote if you were a holder of record of our common stock at the close of business on March 9, 2010.20, 2013, the record date. We are first sending the Notice of Annual Meeting, Proxy Statement and our 2012 Annual Report on April 10, 2013 to all stockholders entitled to vote at the meeting. Whether or not you plan to attend the annual meeting, please vote in one of the following ways:

Use the toll-free number shown on your proxy card (this call is toll-free if made in the United States or Canada);

Go to the website address shown on your proxy card and vote via the Internet; or

Mark, sign, date and return the enclosed proxy card in the postage-paid envelope.

| ||

| ELIZABETH A. ABDOO | ||

Secretary | ||

April 1, 2010

Please refer to the back page of the Proxy Statement for information on accommodations and directions to the hotel.10, 2013

PROXY STATEMENT

| Page | |||||

| 1 | |||||

| 2 | |||||

| 6 | |||||

| 6 | |||||

| 6 | |||||

| 6 | |||||

| 7 | |||||

| 8 | |||||

| 9 | |||||

| 10 | |||||

| 12 | |||||

| 13 | |||||

• Compensation Policy Committee Interlocks and Insider Participation | 13 | ||||

| 13 | |||||

| 15 | |||||

| 15 | |||||

| 15 | |||||

| 18 | |||||

Proposal Two—Ratification of Appointment of Independent Registered Public Accountants |

| 24 | |||

| 25 | |||||

| 26 | |||||

| 26 | |||||

• Pre-Approval Policy for Services of Independent Registered Public Accountants | 26 | ||||

| 26 | |||||

| 27 | |||||

| 28 | |||||

• | 28 | ||||

• Results | 29 | ||||

i

Important Notice Regarding the Availability of Proxy Materials for the Stockholders Meeting to be held on Thursday, May 6, 2010.16, 2013.

The Proxy Statement and 2012 Annual Report to Stockholders are available at

http://www.hosthotels.com/investorrelations.asp

ii

This summary highlights information contained elsewhere in this proxy statement. This summary does not contain all of the information that you should consider, and you should read the entire proxy statement carefully before voting.

Annual Meeting of Stockholders

• Time and Date | 10:00 a.m. EDT, May 16, 2013 | |

• Place | Ritz-Carlton Tysons Corner | |

1700 Tysons Boulevard | ||

McLean, Virginia | ||

• Record Date | March 20, 2013 | |

• Number of Common Shares eligible to vote at the meeting as of the record date:738,661,401 | ||

Voting Matters

Matter | Board Recommendation | Page Reference (for more detail) | ||

| Election of Directors | FOR each director nominee | 18 | ||

Ratification of Appointment of KPMG LLP | FOR | 24 | ||

Advisory Resolution to Approve Executive Compensation | FOR | 57 |

Board Nominees

The following table provides summary information about each director nominee. Directors are elected annually by a majority of votes cast.

Name, Age | Director Since | Occupation | Committee | Other Public Company | ||||

| Sheila C. Bair, 59 | 2012 | Advisor to Pew Charitable Trusts, former chair of the FDIC | None | |||||

| Robert M. Baylis, 74 | 1996 | Retired Vice Chair of CS First Boston | NCG (C), C, LD | |||||

| Terence C. Golden, 68 | 1995 | Chairman of Bailey Capital Corporation | None | Pepco Holdings, Inc. | ||||

Ann McLaughlin Korologos, 71 | 1993 | Former Chair of RAND Corporation Board of Trustees | C (C), NCG | Kellogg Company AMR Corporation Harman International Industries Vulcan Materials Company | ||||

| Richard E. Marriott, 74 | 1979 | Chairman of the Board | None | |||||

| John B. Morse, Jr., 66 | 2003 | Retired Vice President and CFO of The Washington Post Company | A (C) (F), NCG | AES Corporation HSN, Inc. | ||||

| Walter C. Rakowich, 55 | 2012 | Retired Chief Executive Officer of Prologis | A (F), C | |||||

| Gordon H. Smith, 60 | 2009 | President & CEO of the National Association of Broadcasters | A, NCG | |||||

| W. Edward Walter, 57 | 2007 | President and Chief Executive Officer | None | AvalonBay Communities |

| * | A | Audit Committee | C | Compensation Policy Committee | ||||

| (C) | Chair of the Committee | NCG | Nominating and Corporate Governance Committee | |||||

| (F) | Financial Expert | LD | Lead Director |

| Q. | What is a proxy? |

It is your legal designation of another person to vote the stock you own. That other person is called a proxy. If you designate someone as your proxy in a written document, that document is also called a proxy or a proxy card. This proxy is being solicited by the Board of Directors, and we have designated Larry K. Harvey and Elizabeth A. Abdoo as proxies for this annual meeting. When you properly sign your proxy card or vote via telephone or the Internet, you are giving the persons named on the card your direction to vote your shares of common stock at the annual meeting as you designate.

| Q. | What is a proxy statement? |

It is a document that summarizes information that we are required to provide you under the rules of the Securities and Exchange Commission, or SEC, when we ask you to vote your shares or designate a proxy. It is designed to assist you in voting.

| Q. | What does it mean if I get more than one proxy card? |

You should vote by completing and signing each proxy card you receive. You will receive separate proxy cards for all of the shares you hold in different ways, such as jointly with another person, or in trust, or in different brokerage accounts.

| Q. | What |

WithStockholder of Record. If your shares are registered directly in your name with the Company’s transfer agent, Computershare Trust Company, N.A., or Computershare, you are considered the stockholder of record with respect to each nominee, stockholders may:those shares, and the Notice of Annual Meeting, Proxy Statement and our 2012 Annual Report were sent directly to you by the Company.

VoteBeneficial Owner of Shares Held in favorStreet Name. If your shares are held in an account at a brokerage firm, bank, broker-dealer, or other similar organization, then you are the beneficial owner of shares held in “street name,” and the nominee;

Vote againstNotice of Annual Meeting, Proxy Statement and our 2012 Annual Report were forwarded to you by that organization. The organization holding your shares is considered the nominee; or

Abstain fromstockholder of record for purposes of voting forat the nominee.

Stockholders may:

Voteannual meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares held in favor of the ratification;your account.

Vote against the ratification; or

Abstain from voting on the ratification.

| Q. | Who is entitled to vote? |

Anyone who owned common stock of the Company at the close of business on March 9, 2010,20, 2013, the record date, can vote at the annual meeting. We are first sending the enclosed proxy card and this proxy statement on April 1, 2010 to all stockholders entitled to vote at the meeting.

| Q. | How can I manage the number of Annual Reports I receive? |

Our 2009The included glossy 2012 Annual Report together withand our Annual Report on Form 10-K for the year ended December 31, 2012 filed with the SEC has been(which together comprise the 2012 Annual Report of the Company), is being mailed to stockholders with this proxy statement.Proxy Statement. If you share an address

with any of our other stockholders, your household might receive only one copy of these

documents. To request individual copies for each stockholder in your household, please contact our Investor Relations department at 240-744-1000, by e-mail to ir@hosthotels.com, or by mail to Host Hotels & Resorts, Inc., 6903 Rockledge Drive, Suite 1500, Bethesda, MD 20817, Attn: Investor Relations. To ask that only one set of the documents be mailed to your household, please contact your bank, broker or other nominee or, if you are a stockholder of record, please call our transfer agent, Computershare Trust Company, N.A. (“Computershare”) at 866-367-6351 toll-free within the United States and Canada; outside the United States and Canada at 781-575-4320, or by mail at P.O. Box 43078, Providence, Rhode Island 02940.

| Q. | How do I vote? |

Voting in Person at the Meeting. If you are a stockholder of record as of the close of business on March 9, 201020, 2013 and attend the annual meeting, you may vote in person at the meeting. If your shares are held by a broker, bank or other nominee (i.e., in “street name”) and you wish to vote in person at the meeting, you will need to obtain a proxy form from the broker, bank or other nominee that holds your shares of record.

Voting by Proxy for Shares Registered Directly in the Name of the Stockholder. If you hold your shares in your own name as a holder of record, you may vote your shares as follows:

| • | Vote by Telephone. You may vote by telephone by calling the toll-free number listed on the accompanying proxy card. Telephone voting is available 24 hours per day until 11:59 p.m., Eastern Time, on Wednesday, May |

| • | Vote by Internet. You also have the option to vote via the Internet. The website for Internet voting is printed on your proxy card. Internet voting is available 24 hours per day until 11:59 p.m., Eastern Time, on Wednesday, May |

| • | Vote by Mail. If you would like to vote by mail, mark your proxy card, sign and date it, and return it to Computershare in the postage-paid envelope provided. |

Voting by Proxy for Shares Registered in Street Name. If your shares are held in street name, you will receive instructions from your broker, bank or other nominee which you must follow in order to have your shares of common stock voted.

| Q. | Who is acting as my proxy and how will they vote my |

The individuals named on the enclosed proxy card are your proxies. They will vote your shares as you indicate. If you sign and return your proxy card but do not indicate how you wish to vote and you hold your shares in your own name as a holder of record, all of your shares will be voted:voted as recommended by the Board of Directors.

However, if you hold your shares in street name, it is critical that you cast your vote in order for your vote to count in the election of directors (proposal one).count. In the past, if you held your shares in street name and you did not indicate how you wanted to vote those shares, in the election of directors, your bank or broker was allowed to vote those shares on your behalf in the election of directors and other routine matters as they deemed appropriate. Now, due to recent regulatory changes, your bank or broker is no longer is able to vote your shares on a

discretionary basis in the election of directors.most matters. If you hold your shares in street name and do not instruct your bank or broker how to vote, in the election of directors, then no votes will be cast on your behalf in the election of directors. Your bank or broker will continue to have discretion to vote your shares onfor all matters other than the ratification of the appointment of KPMG LLCLLP as the Company’s independent registered public accountants for 20102013 (proposal two) if you do not provide instructions on this proposal.2).

| Q. | May I revoke my proxy? |

You may revoke your proxy at any time before the annual meeting if you:

| (1) | File a written notice of revocation dated after the date of your proxy with Computershare; or |

| (2) | Send Computershare by mail a later-dated proxy for the same shares of common stock; or |

| (3) | Submit a new vote by telephone or the Internet. The date of your last vote, by either of these methods or by mail, will be the one that is counted; or |

| (4) | Attend the annual meeting AND vote there in person. |

The mailing address for Computershare is P.O. Box 43078, Providence, Rhode Island 02940. The overnight delivery address for Computershare is: 250 Royall Street, Canton, Massachusetts 02021.

| Q. |

At the close of business on March 9, 2010, there were 654,455,636 shares of our common stock issued and outstanding. Every stockholder is entitled to one vote for each share of common stock held.

| What vote is required to approve each proposal? |

In the election of directors, each nominee must receive more “For” votes than “Against” votes in order to be elected as a director. The proposalaffirmative vote of a majority of votes cast at the meeting is required to ratify the appointment of KPMG LLP as the Company’s independent registered public accountants for 2010 requires approval by2013 and to approve the affirmative vote of a majority of votes castadvisory resolution on the proposal.

| Q. | What constitutes a “quorum”? |

A majority of the outstanding shares entitled to vote, present in person or by proxy, constitutes a quorum. We must have a quorum to conduct the annual meeting. If a quorum is not present or if we decide that more time is necessary for the solicitation of proxies, we may adjourn the annual meeting. We may do this with or without a stockholder vote. If there is a stockholder vote to adjourn, the named proxies will vote all shares of common stock for which they have voting authority in favor of the adjournment.

| Q. | How are abstentions and broker non-votes treated? |

Shares of our common stock represented by proxies that are marked “abstain,” or which constitute broker non-votes, will be counted as present at the meeting for the purpose of determining a quorum. Broker non-votes occur when a nominee holding shares of our common stock for a beneficial owner returns a properly executed proxy but has not received voting instructions from the beneficial owner and such nominee does not possess or does not choose to exercise discretionary authority with respect to such shares. Abstentions and broker non-votes will have no effect on the results of the vote on the election of directors or the results of the vote to ratify the appointment of KPMG LLP.proposals 2 and 3.

| Q. | How can I obtain copies of documents referenced in this proxy statement? |

Copies of the Company’s Corporate Governance Guidelines, codes of conduct and other documents referenced in this proxy statement can be accessed in the “Investor Relations—Governance” section of the Company’s website athttp://www.hosthotels.com. Copies of these documents are also available in print to stockholders upon request by writing to:

Host Hotels & Resorts, Inc.

6903 Rockledge Drive, Suite 1500

Bethesda, Maryland 20817

Attention: Investor Relations

| Q. | How will voting on any other business be conducted? |

Although we do not know of any other business to be considered at the annual meeting other than the proposals described in this proxy statement, if any other business is properly presented at the annual meeting your signed proxy card gives authority to Larry K. Harvey and Elizabeth A. Abdoo, or either of them, to vote on such matters in their discretion. Unless otherwise required by our Charter or Bylaws or by applicable Maryland law, any other matter properly presented for a vote at the meeting will require the affirmative vote of a majority of the votes cast.

| Q. | Who will count the votes? |

Computershare Trust Company, N.A., our transfer agent, will act as the inspectors of election and will tabulate the votes.

| Q. | Who pays the cost of this proxy solicitation? |

We bear all expenses incurred in connection with the solicitation of proxies. We have hired the firm of MacKenzie Partners, Inc. to assist in the solicitation of proxies for a fee of $7,000,$10,000, plus expenses. We will reimburse brokers, fiduciaries and custodians for their reasonable expenses related to forwarding our proxy materials to those beneficial owners.

| Q. | Is this proxy statement the only way that proxies are being solicited? |

No. In addition to mailing these proxy solicitation materials, our officers and employees may solicit proxies by further mailings or personal conversations, or by telephone, facsimile or other electronic means.

| Q. | How can I find out the results of the voting at the annual meeting? |

Preliminary voting results will be announced at the annual meeting. Final voting results will be disclosed on a Form 8-K filed with the SEC within four business days of the date of the annual meeting, which will be available on the Company’s website athttp://www.hosthotels.com.

CORPORATE GOVERNANCE AND BOARD MATTERS

Our Board of Directors oversees the management of the Company and its business for the benefit of our stockholders in order to enhance stockholder value over the long-term. The Board has adopted Corporate Governance Guidelines in 2002. These Guidelineswhich are reviewed annually and periodically amended as the Board enhances the Company’s corporate governance practices. The Company’s Corporate Governance Guidelines, codes of conduct and other documents describing the Company’s corporate governance practices can be accessed in the “Investor Relations—Governance” section of the Company’s website athttp://www.hosthotels.com. Copies of these documents are also available in print to stockholders upon request.

In recent years, the Board has implemented numerous corporate governance enhancements to further strengthen the Board’s capacity to oversee the Company and to serve the long-term interests of all stockholders. These include:

amending the Company’s Bylaws to change the voting standard for the election of directors from a plurality to a majority of all of the votes cast in uncontested elections;

amending the Company’s Charter to declassify the Board of Directors so that all directors are elected on an annual basis; and

allowing the expiration of the Company’s Stockholder Rights Plan in November 2008.

The Company invites stockholders and other interested parties to communicate any concerns they may have about the Company directly and confidentially with any of (i) the full Board of Directors, (ii) the presiding directorLead Director or (iii) the non-management directors as a group, by writing to the Board of Directors, the PresidingLead Director or the Non-Management Directors at Host Hotels & Resorts, Inc., 6903 Rockledge Drive, Bethesda, MD 20817, Attn: Secretary. The Secretary will review and forward all stockholder communications to the intended recipient except those unrelated to the duties and responsibilities of the Board, such as junk mail and mass mailings, resumes and other forms of job inquiries, surveys, new business suggestions, business solicitations or advertisements. In addition, material that is hostile, threatening, illegal or similarly unsuitable or outside the scope of Board matters or duplicative of other communications previously forwarded to the recipient will also be excluded. The Secretary shall retain for three years copies of all stockholder communications that are forwarded.

Code of Business Conduct and Ethics

The Board has also adopted a code of business conduct and ethics that applies to all officers and employees of the Company and a code of business conduct and ethics and conflict of interest policy that applies to the Board of Directors.Board. The purpose of these codes of conduct is to promote honest and ethical conduct; to promote full, fair, accurate, timely and understandable disclosure in periodic reports required to be filed by the Company; and to promote compliance with all applicable rules and regulations that apply to the Company and its officers, employees and directors.

Our governance structureframework provides the Board with the flexibility to select the appropriate leadership structure for the Company. This will be driven by the needs of the Company as well as the particular makeup of the Board of Directors at any point in time. As a result, no policy exists requiring the combination or separation of leadership roles, and the Company’s governing documents do not mandate a particular structure.

Our current leadership structure is comprised of the Chairman of the Board, a separate Chief Executive Officer, an independent director serving as the presiding director ofLead Director who presides over the non-management directors, and strong active independent directors. The CEO is responsible for setting the strategic direction of the Company and for the day to day leadership and management of the Company, while the Chairman of the Board provides guidance to the CEO, directs the agenda for Board meetings and presides over meetings of the full Board of Directors.Board. This structure reflects the continued strong leadership, industry experience and energy brought to the Board of Directors by Richard E. Marriott, who has led the Company as Chair since its split with Marriott International in 1993. His over 47 year career at the Company uniquely provides him with a perspective and wealth of knowledge that is invaluable to the Board.

Another component of our leadership structure is the active role played by our independent directors in overseeing the Company’s business, both at the Board and Committee level. SixSeven of eightnine of our current directors nominees are considered independent within the meaning of the rules of the New York Stock Exchange. Under our Corporate Governance Guidelines, non-management directors meet in executive session without the presence of the CEO, the Chairman of the Board or other executive officers. The purpose of these sessions is to promote open discussions among the independent directors concerning the business and affairs of the Company as well as matters concerning management, without any member of management present. In accordance with our Corporate Governance Guidelines, the

The Chair of our Nominating and Corporate Governance Committee, Robert M. Baylis, presides atserves as our Lead Director. As such, he convenes and chairs all meetings of non-management directors in executive sessions of non-management directors. Mr. Baylis alsoon a quarterly basis and more, if needed, serves as the principal liaison between the non-employee directors and the CEO and Chairman, and serves as the director to whom correspondence may be directed on behalf of the non-management directors as a group, as described above under “Corporate Governance.” The position and role of the Lead Director is intended to expand lines of communication between the Board and members of management. It is not intended to reduce the free and open access and communications that each independent board member has with other board members and members of management.

At least annually, the Nominating and Corporate Governance Committee discusses the structure and composition of the Board of Directors and reviews the current leadership structure. This is discussed with the full Board as part of the Board’s annual evaluation to assess its effectiveness and takes into account our current business plans and long-term strategy as well as the particular makeup of the Board at that time.

It is the Board’s policy that a majority of the directors of the Company be independent. To be considered independent, a director must not have a material relationship with the Company that could interfere with a director’s independent judgment. To be considered independent, directors must also be “independent” within the meaning of the New York Stock Exchange’s requirements. To assist the Board in determining whether a director is independent, the Board has adopted standards for independence set forth in the Company’s Corporate Governance Guidelines.

Under these standards, a director is not considered independent if, within the past three years:

the director was employed by the Company (except on an interim basis);

an immediate family member of the director was an executive officer of the Company;

the director or an immediate family member is a partner at the Company’s internal or external auditors;

the director or an immediate family member was a partner or employee of the Company’s internal or external auditors and worked on the Company’s audit;

the director or an immediate family member is employed as an executive officer of another company when a present officer of the Company satserved on that company’s compensation committee;

the director or an immediate family member received, during any 12-month period, more than $120,000 in compensation from the Company, other than director or committee fees or deferred compensation (provided such deferred compensation is not contingent in any way on continued service);

the director or an immediate family member is an employee of a company that makes payments to or receives payments from the Company for property or services in excess of the greater of $1 million or 2% of that company’s consolidated gross revenue over one fiscal year; or

the director or an immediate family member is an executive officer, director, or trustee of a tax exempt organization to which the Company makes contributions in an amount that, in any single fiscal year, exceeds the greater of $1 million or 2% of the tax exempt organization’s consolidated gross revenues.

In addition, the Board of Directors also considers the following factors, among others, in making its independence determinations:

whether the director, or an organization with which the director is affiliated, has entered into any commercial, consulting, or similar contracts with the Company; and

whether the director receives any compensation or other fees from the Company, other than the fees described under “Director Compensation”.Compensation.”

Consistent with these considerations, the Nominating and Corporate Governance Committee reviewed directors’ responses to a questionnaire asking about their relationships with the Company, as well as those of their immediate family members, and other potential conflicts of interest. The Committee determined that all of the directorsdirector nominees other than Mr. Marriott and Mr. Walter are independent and recommended this conclusion to the Board.Board that Messrs. Baylis, Golden, Morse, Smith and Rakowich and Ms. Korologos and Ms. Bair have been determined to be independent. The Board approved the determination that sixseven of the Company’s eight directorsnine director nominees are independent. Messrs. Marriott and Walter are not independent because they are Company employees.

PricewaterhouseCoopers (“PWC”) has served, since 1998, as the Company’s internal auditor. Mr. Brittain retired from PWC in 2002, and receives unfunded retirement and other benefits from PWC, a portion of which is variable depending on PWC’s financial results. Mr. Brittain has never been involved in any matters concerning the Company. The Board determined that these factors alone would not impede a determination of independence for Mr. Brittain.

The Board’s Role in Risk Oversight

TheOur Board asof Directors has overall responsibility for risk oversight with a whole overseesfocus on the variousmost significant risks facing the Company, with reviewsCompany. Reviews of certain areas beingare conducted by the relevant Committees that report on their deliberations to the Board. In this regard, the Board seeks to understand and oversee critical business risks. Risks are considered in almost all business decisions and as part of the Company’s business

strategy. The Board recognizes that it is neither possible nor prudent to eliminate all risk. Indeed, appropriate risk-taking is essential for the Company to be competitive and to achieve its business objectives.

The chart below summarizes the primary areas of risk oversight for the Board and its Committees.committees.

Board/Committee | Primary Areas of Risk Oversight | |

| Full Board | Strategic, financial and execution risks and exposures associated with the annual business plan, and strategic plan; major litigation and regulatory exposures, environmental and other current matters that may present material risk to the Company’s operations, plans, prospects or reputation; | |

| Audit Committee | Discusses guidelines and policies with respect to the Company’s risk assessment and risk management processes. Responsible for oversight of risks associated with financial matters, particularly the Company’s financial statements, tax, accounting, and disclosure; risks associated with derivatives and hedging strategy; risks associated with the independence, qualifications and performance of the Company’s outside auditor and internal auditors; and the Company’s compliance with legal and regulatory requirements. | |

| Compensation Policy Committee | Exposures associated with compensation of the Company’s officers, stock ownership and incentive-compensation plans, executive retention, succession planning and | |

| Nominating and Corporate Governance Committee | Risks and exposures relating to the identification of qualified candidates to become Board members; continuing oversight of Board composition; review of the structure, membership and charters of the Board committees; review of compensation for independent directors; and oversight of the evaluation of the Board and management. | |

The Board and its Committeescommittees implement their oversight responsibilities through management reporting processes that are designed to provide visibility to the Board about the identification, assessment and management of critical risks and management’s risk mitigation strategies. These areas of focus include strategic, operating, financial, legal, compliance and reputational risk. Management communicates routinely with the Board, its Committees and individual directors on the significant risks identified through this process and how they are being managed.

The Company does not have a Political Action Committee nor does it make contributions to political parties or individual candidates. The Company does contribute to trade associations and organizations, such as the National Association of Real Estate Investment Trusts (NAREIT), the American Hotel & Lodging Association, U.S. Travel Association and Real Estate Round Table and has memberships with the Maryland Chamber of Commerce and DC Chamber of Commerce. The Company’s participation as a member of these various industry and trade groups comes with the understanding that we may not always agree with the positions of the larger organization and/or other members, and that we are committed to voicing our concerns as appropriate through our employees who may serve on the board and committees of these groups.

Meetings and Committees of the Board

The Board met sevensix times in 2009.2012. Each director attended at least 75%80% of the meetings of the Board and of the committees on which the director served. The Company expectsUnder the Corporate Governance Guidelines, directors are expected to attend the annual meeting of stockholders. Allstockholders, and all directors attended the annual meeting in 2009.2012. Under our Corporate Governance Guidelines, non-management directors meet in executive session without management and did so after each regularly scheduled

Board meeting in 2009.2012. Mr. Baylis, the Chair of the Nominating and Corporate Governance Committee and Lead Director, presided over the executive sessions of the non-management directors.

The Board has established three standing committees to assist it in carrying out its responsibilities: the Audit Committee, the Compensation Policy Committee and the Nominating and Corporate Governance Committee. The Board has adopted a written charter for each committee, all of which are available on the Company’s website (http://www.hosthotels.com). Copies of these charters are also available in print to stockholders upon request. SeeHow can I obtain copies of documents referenced in this proxy statement?Each committee consists entirely of independent directors in accordance with New York Stock Exchange rules. The Board generally makes committee assignments in May after the annual meeting of stockholders, upon recommendation of the Nominating and Corporate Governance Committee. The Board may from time to time appoint other committees as circumstances warrant. Any new committees will have authority and responsibility as delegated by the Board of Directors.Board.

Committee | Current Members | Number of Meetings Held in | ||

| Audit (1) | John B. Morse, Jr. (Chair)

Gordon H. Smith | • Number of meetings: Seven

• Appoints and oversees the independent auditors;

• Approves the scope of audits and other services to be performed by the independent and internal auditors;

• Reviews and approves in advance the engagement fees of the outside auditor and all non-audit services and related fees, and assesses whether the performance of non-audit services could impair the independence of the independent auditors; • Reviews the work and findings, if any, of the internal auditors;

• Reviews the results of internal and external audits, the accounting principles applied in financial reporting, and financial and operational controls;

• Meets with the independent auditors, management representatives and internal auditors;

• Reviews interim financial statements each quarter before the Company files its Quarterly Report on Form 10-Q with the SEC;

• Reviews audited financial statements each year before the Company files its Annual Report on Form 10-K with the SEC; and

• Reviews risk exposures and management policies. |

| (1) |

Committee | Current Members | Number of Meetings Held in | ||

Nominating and Corporate Governance | Robert M. Baylis (Chair) Ann McLaughlin Korologos John B. Morse, Jr. Gordon H. Smith | • Number of meetings: Four

• Makes recommendations to the Board on corporate governance matters and is responsible for keeping abreast of corporate governance developments;

• Oversees the annual evaluation of the Board, its committees and management;

• Reviews periodically the compensation and benefits of non-employee directors and makes recommendations to the Board

• Reviews the composition of the Board and skills of directors and recommends nomination of Board members and addition of new members, as appropriate;

• Ensures that the Board maintains its diversity; • Reviews policies and programs on matters of corporate responsibility and sustainability, including environmental, social and other matters; and

• Fulfills an advisory function with respect to a range of matters affecting the Board and its committees, including making recommendations with respect to:

— selection of committee chairs and committee assignments; and

— implementation, compliance and enhancements to codes of conduct and the Company’s Corporate Governance Guidelines. |

In addition, the Chair of the Nominating and Corporate Governance Committee is the Lead Director and presides at all executive sessions of independent directors, determines the agenda for such discussions, and serves as liaison between the independent directors and the Chairman and the Chief Executive Officer.

Committee | Current Members | Number of Meetings Held in | ||

| Compensation Policy | Ann McLaughlin Korologos (Chair) Robert M. Baylis

| • Number of meetings:

• Oversees compensation policies and plans for the Company’s employees;

• Reflects the Company’s compensation philosophy in structuring compensation programs;

• Approves the goals and objectives for compensation of all executive officers of the Company and approves compensation for other members of senior management;

• Advises our Board on the adoption of policies that govern the Company’s annual compensation and stock ownership plans;

• Reviews and approves the Company’s goals and objectives relevant to the compensation of the CEO and evaluates the CEO’s performance in light of those goals and objectives;

• Reviews and advises the Company on the process used for gathering information on the compensation paid by other similar businesses;

• Reviews the Company’s succession plans relating to the CEO and other senior

• Reviews periodic reports from management on matters relating to the Company’s personnel appointments and practices. |

Role of the Compensation Consultant

Pursuant to its charter, the Compensation Policy Committee is authorized to retain and terminate any consultant, as well as approve the consultant’s fees, scope of work and other terms of retention. In 2005,October 2010, the Committee retained Pay Governance LLC as its advisor. Pay Governance advises and consults with the Committee on compensation consultant Towers Perrin (known as Towers Watson after merging with Watson Wyatt Worldwide effective January 1, 2010). Towers Watson hasissues, compensation design, and keeps the Committee apprised of regulatory, legislative, and accounting developments and competitive practices related to executive compensation. Pay Governance assisted the Committee in the design, structure and implementation of the executive compensation programsprogram for 2006-2008 and 2009-2011. In addition, Towers Watson advises the Committee on compensation issues and keeps the Committee apprised of regulatory developments and competitive practices related to executive compensation practices.2012. They do not determine or recommend the exact amount or form of executive compensation for any executive officers. Towers WatsonSee “Compensation Discussion and Analysis - New 2012 Compensation Program.” Pay Governance reports directly to the Committee. ACommittee, and a representative of Towers Watson,Pay Governance, when requested, attends meetings of the Committee, is available to participate in executive sessions and communicates directly with the Committee Chair or its members outside of meetings. The Chair of the Committee, acting on authority delegated by the Committee, approves anyPay Governance does no other work that Towers Watson may do for the Company and its affiliates. In 2009, Towers Watson performed work for the Company and the Company’s European joint venture, in which the Company has a 32% interest and acts as general partner. The work related to assistanceCompany.

In compliance with the valuationdisclosure requirements of pension obligations for financial reporting purposes in Italy, Spain, The Netherlands and Chile. Fees associatedthe SEC regarding the independence of compensation consultants, Pay Governance addressed each of the six independence factors established by the SEC with the Compensation Policy Committee. Its responses affirmed the independence of Pay Governance on executive compensation matters. Based on this assessment, the Committee determined that the engagement of Pay Governance does not raise any conflicts of interest or similar concerns.

this work were approximately $62,220 in 2009. The individuals involved in providing compensation consulting do not provide these other services and there is no communication between those providing compensation services and consultants providing such other services. The Compensation Policy Committee may delegate any or all of its responsibilities to a subcommittee, but did not do so in 2009.2012. The Compensation Policy Committee’s Report on Executive Compensation appears later in this proxy statement.

The Compensation Policy Committee oversees the compensation policies and plans for all employees. Management, at the request of the Committee, has assessed the Company’s compensation programs and has concluded that they do not create risks that are reasonably likely to have a material adverse effect on the Company. This risk assessment process included a review of all material compensation policies and practices, which waswere discussed with the Committee. The compensation programs of the Company are all centrally designed and centrally administered. They do not vary by department or business operations. The elements of compensation for senior management and upper middle management are also the same: base salary, annual cash incentive awards and long-term incentives. The performance measures for the annual cash incentive awards are (i) Company financial metrics that are based on an annual business plan and budget reviewed and approved by the Board of Directors and (ii) personal performance goals that are derived from the annual business plan and budget and Company strategic plan, which tie to measures of long-term success of the Company. The business plan and budget are reviewed quarterly with the Board and the strategic plan is addressed annually. The personal goals are drafted by each employee annually and approved by each manager sowith the intent that there is a common purpose and accountability throughout the Company. Performance measures for long-term incentives are personal goals, corporate goals, which are tied to the business plan and budget, and total stockholder return measures. Total compensation is capped throughout our compensation programs, and the Compensation Policy Committee reviews all senior management compensation and that of any employee earning more than $250,000$500,000 in cash compensation.annual target compensation, which would include salary, bonus and equity awards. Based on the foregoing, we believe that our compensation policies and practices do not create inappropriate or excessive risk-taking.

Compensation Policy Committee Interlocks and Insider Participation

None of the members of the Compensation Policy Committee is or has been an officer or employee of the Company or had any relationship that is required to be disclosed as a transaction with a related person.

Identification and Evaluation of Director Candidates

Each year the Nominating and Corporate Governance Committee reviews with the Board of Directors the composition of the Board as a whole and makes a recommendation whether to renominate directors and whether to consider any new persons to be added to the Board of Directors.Board. The Committee considers director candidates suggested by members of the Committee, other directors and management. Starting in 2011, the Committee engaged the services of a third party search firm, Heidrick & Struggles, to assist in identifying and evaluating director candidates. The Committee will also consider any written suggestions of stockholders for director nominees. The recommendation must include the name and address of the candidate, a brief biographical description and a description of the person’s qualifications. Recommendations should be mailed to Host Hotels & Resorts, Inc.,

6903 Rockledge Drive, Suite 1500, Bethesda, MD 20817, Attn: Secretary. The Committee will evaluate in the same manner candidates suggested in accordance with this policy and those recommended by other sources. The Committee has full discretion in considering all nominations to the Board of Directors.Board. Alternatively, stockholders who would like to nominate a candidate for director (in lieu of making a recommendation

to the Nominating and Corporate Governance Committee) must comply with the requirements described in this proxy statement and the Company’s Bylaws. See “Stockholder Proposals for our Next Annual Meeting.”

The evaluation of director candidates involves several steps, not necessarily in any particular order. Preliminary interviews of director candidates may be conducted by the Chair of the Committee or, at his request, any other member of the Committee, the Chairman of the Board, or other directors. Background material pertaining to director candidates is distributed to the members of the Committee for their review. References are checked and analyses are performed to identify potential conflicts of interest and appropriate independence from the Company. Director candidates who the Committee determines merit further consideration are interviewed by the Chair of the Committee and other Committee members, directors and executive officers as determined by the Chair of the Committee. The results of these interviews are considered by the Committee in its deliberations.

There are certain minimum qualifications for Board membership that director candidates should possess, including strong values, high ethical standards, mature and independent judgment, diverse business experience, familiarity with the issues affecting the Company’s business, and a commitment to full participation on the Board and its committees. The Committee has adopted guidelines in its charter to be used in evaluating candidates in order to ensure a diverse and highly qualified Board of Directors.Board. In addition to the characteristics mentioned above, the guidelines provide that the Committee may consider the following criteria, including: experience in running a major enterprise, sound business acumen, experience as a board member of another publicly held company, academic expertise in an area of the Company’s operations, and a reputation, both personal and professional, consistent with the image and reputation of the Company. In addition, when considering new Board members, the Committee considers whether the candidate would qualify as an independent director under New York Stock Exchange rules and other applicable regulations.

The Board is also committed to a diversified membership, in terms of both the individuals involved and their experience. As stated in the Committee’s Charter,charter, the Committee may take into account the overall diversity of the Board, including professional background, experience, perspective, age, tenure, gender, and ethnicity. The Board is satisfied that the current nominees reflect an appropriate diversity of gender, race, age, professional background and experience but is committed to continuing to consider diversity issues in evaluating the composition of the Board.

This year, twoone new directorsdirector who havehas not previously stood for election to the Board by the stockholders, Willard W. Brittain, Jr. and Gordon H. Smith, areMs. Sheila C. Bair, is nominated for election to the Board of Directors. Both directors wereMs. Bair was identified as a candidate by an existing Board membersmember and elected to the Board in July 2009. Eacheffective October 31, 2012 on the recommendation of the Committee. Ms. Bair qualifies as an independent director under New York Stock Exchange rules.

Directors who are employees receive no additional compensation for serving on the Board or its committees. In 2009,2012, we provided the following annual compensation to our independent directors.

Name (1) | Fees Earned or Paid in Cash (2) | Stock Awards | All Other Compensation (3) | Total | Fees Earned or Paid in Cash (2) | Stock Awards (3) | All Other Compensation (4) | Total | |||||||||||||||||||||

Sheila C. Bair | $ | 10,833 | $ | 52,500 | $ | 0 | $ | 63,333 | |||||||||||||||||||||

Robert M. Baylis | $ | 100,500 | $ | 65,0009 | (4) | $ | 18,752 | $ | 184,252 | 102,500 | 90,000 | 36,213 | 228,713 | ||||||||||||||||

Willard W. Brittain, Jr. | 38,500 | 54,167 | (5) | 11,851 | 104,518 | ||||||||||||||||||||||||

Terence C. Golden | 68,000 | 65,000 | (4) | 21,445 | 154,445 | 66,500 | 90,000 | 6,608 | 163,108 | ||||||||||||||||||||

Ann McLaughlin Korologos | 90,000 | 65,000 | (4) | 25,691 | 180,691 | 92,500 | 90,000 | 48,623 | 231,123 | ||||||||||||||||||||

John B. Morse, Jr. | 99,500 | 65,000 | (4) | 43,844 | 208,344 | 101,500 | 90,000 | 27,288 | 218,788 | ||||||||||||||||||||

Walter C. Rakowich | 71,000 | 90,000 | 51,647 | 212,647 | |||||||||||||||||||||||||

Gordon H. Smith | 40,000 | 54,167 | (5) | 9,338 | 103,505 | 86,500 | 90,000 | 28,517 | 205,017 | ||||||||||||||||||||

| (1) | Mr. Marriott, Chairman of the Board, and Mr. Walter, President and CEO, are not included in this table because they are employees of the Company and thus receive no compensation for services as directors. The compensation received by Mr. Marriott and Mr. Walter as employees is shown in “Executive Officer Compensation.” |

| (2) | Amount reflects an annual retainer for Board service, |

| (3) | Amount reflects annual stock awards made pursuant to the Non-Employee Directors’ Deferred Stock Compensation Plan in value equal to $90,000. The annual stock awards are fully vested upon grant. Ms. Bair’s award was prorated based on her time of service. |

| (4) | Amount reflects: |

Complimentary rooms, food and beverage and other hotel services for directors when they stay at properties owned by us or managed by our major operators as follows: Mr. Baylis, $11,073; Mr. Brittain, $6,639;$21,384; Mr. Golden, $11,591;$3,608; Ms. Korologos, $13,886;$26,767; Mr. Morse, $25,342;$15,772; Mr. Rakowich $29,981 and Mr. Smith $5,187.$16,554.

Reimbursement for taxes associated with the value of the above benefit as follows: Mr. Baylis, $7,679; Mr. Brittain, $5,212;$14,829; Mr. Golden, $9,854;$3,000; Ms. Korologos, $11,805;$21,856; Mr. Morse, $18,502;$11,515; Mr. Rakowich $21,666 and Mr. Smith $4,151.$11,963.

Directors are compensated in cash and stock to align their interests with those of our stockholders. The components of director compensation are discussed below.

Cash Compensation

The Company provides non-employee directors the following cash compensation in addition to reimbursement of customary and usual travel expenses.

retainer of $65,000 per year;

$1,5008,000 per year for each committee meeting attended;

$1,500 for attendance atmembership on the annual meeting of stockholders;Compensation Policy Committee or Nominating and Corporate Governance Committee;

$12,000 per year for membership on the Audit Committee;

$10,000 per year to the committee chair of the Compensation Policy Committee (Ms. Korologos) and the committee chair of the Nominating and Corporate Governance Committee (Mr. Baylis); and

$15,000 per year to the committee chair of the Audit Committee (Mr. Morse); and

$10,000 per year to the Lead Independent Director (Mr. Baylis).

There are no fees paid for attendance at the 5 regularly scheduled Board meetings, however, non-employee directors would receive $1,500 for attendance at any special meeting, of which there was one in 2009.2012. Similarly, there are no fees paid for attendance at up to five meetings of the Nominating and Corporate Governance Committee and Compensation Policy Committee and up to seven meetings of the Audit Committee; however, non-employee directors receive $1,500 for attendance at any special committee meetings in excess of those amounts, of which there were none in 2012.

Stock Compensation—Annual Stock Award

Stock compensation in 2009 consisted ofNon-employee directors receive an annual award ofdirector stock units equaling the annual retainer fee ($65,000) in value and credited to each director’s deferred stock unit accountaward under the Non-Employee Directors’ Deferred Stock Compensation Plan. Under that plan, the annual award is granted to each director immediately following the annual meeting of stockholders. The number of stock units is calculated by dividing the annual retainer fee by the average of the high and low prices of our common stock on the date ofPlan effective after election at the annual meeting. In 2009,2012, the average of the high and low price of our common stock on May 14, 2009 was $7.89 and each director was credited with 8,244 stock units. On November 4, 2009, the Nominating and Corporate Governance Committee recommended, and the Board approved, a prorated annual award of stock units to Messrs. Brittain and Smith, who both joined the Board in July 2009. The number of stock units awarded was equal to the annual retainer fee multiplied by 10/12 and divided by the average of the high and low prices of our common stock on the grant date.

Directors are also credited with dividend equivalents that are equal in value to the dividends paid on our common stock. The Company will convert the stock units to common stock upon a director’s termination of service from the Board, as more fully described below.

Compensation Changes Effective in 2010

The Nominating and Corporate Governance Committee reviewed the compensation of the independent directors in 2009. Stockholder approval of the Company’s 2009 Comprehensive Stock and Cash Incentive Plan allowed more flexibility structuring directors’ compensation because, unlike the former stock plan, it allows directors to receive grants of equity. Effective January 1, 2010, the Committee recommended, and the Board approved, an increase in the annual stock retainer for independent directors from $65,000 to $75,000, to be made after the annual meeting of stockholdersequaled $90,000, with the number of shares to be determined based on the fair market value of the Company’s common stock on that date. Fair market value under the 2009 Comprehensive Stock and Cash Incentive Plan is the closing price of the Company’s stock on the date of grant. The Committee recommended no increase to the annual cash retainer, committee meeting fees or chair retainers.

Under the Non-Employee Directors’ Deferred Stock Compensation Plan, directors will receive the annual stock award in fully-vested restricted stock, unless a director makes an

election prior to the end of the year preceding the award to defer the award into stock units. Directors also would elect at that time the date when the stock units would be payable, which is either upon termination of service from the Board in a lump sum or in annual installments up to 10 years, or in a lump sum payable the earlier of (i) termination of service or (ii) 3 or 5 years from the date of grant. In addition,All directors elected to defer the Committee implemented new2012 award into stock ownership guidelines effectiveunits. The closing price of our common stock on the annual meeting date of May 10, 2012 was $16.06, so each director received either 5,604 shares or, if they deferred, they were credited with 5,604 stock units. Directors are also credited with dividend equivalents that are equal in 2010. These are discussed below.value to the dividends paid on our common stock.

Stock Ownership Policy

Effective January 1, 2010, non-employee directors must own common stock of the Company (which includes stock units held under the Non-Employee Directors’ Deferred Compensation Plan) equal in value to five times the annual cash retainer ($65,000) paid to directors. Compliance with these guidelines will be measured on the first trading day of each calendar year, using the annual cash retainer then in effect and the closing price of our common stock on that day. Any subsequent change in the value of the common stock will not affect the amount of stock that directors are required to hold during that year. In the event that the annual cash retainer increases, a non-employee director will have five years from the time of such increase to acquire any additional shares needed to meet these guidelines. There will be a transition period of five years for non-employee directors to achieve the ownership requirement. Mr. Marriott and Mr. Walter, as employees, are subject to separate stock ownership guidelines applicable to corporate officers. All directors currently meet the stock ownership guidelines, except Ms. Bair, who joined in October 2012, and Mr. Rakowich, who joined in March 2012, each of whom have four more years to meet the guidelines.

Perquisites

To encourage our directors to visit and personally evaluate and provide feedback on our properties and the managers of our properties, directors receive complimentary rooms, food and beverage and

other hotel services when they stay at properties owned by us or managed by our major operators.operators, subject to an annual limit of $30,000. In addition, directors are reimbursed for taxes associated with the value of this benefit.

Non-Employee Directors’ Deferred Stock Compensation Plan

TheIn addition to the annual stock award, the Non-Employee Directors’ Deferred Stock Compensation Plan allows directors to defer receipt of all or part of their annual cash retainer, meetingcommittee fees, and committee chair fees until after their service on the Board has ended. Under this plan, the Company has established a stock unit account for each non-employee director and all deferred fees are credited to this account as of the date the fee would have been paid. Deferred fees are converted into stock units based on the fair market value of the Company’s common stock on the date the fee otherwise would have been paid. Dividends are “reinvested” in additional stock units and credited to the account in stock units based on the market price of the stock on the date dividends are paid.

With respect to stock units received prior to January 1, 2010, uponUpon termination of service from the Board, a director’s stock unit account is settled by delivering an amount of our shares of common stock equal to the number of stock units, and, with respect to any deferred cash fees, directors had the option to receive such shares as a lump sum or in substantially equal annual installments over a period not to exceed 10 year period.years. With respect to annual stock awards, directors may also elect to defer payment of the award as set forth above.

ELECTION OF DIRECTORS

Our Board of Directors currently consists of eightnine members. Each director nominee stands for election every year. Each nominee has consented to serve if elected, but should any director nominee be unavailable to serve (an event which our Board does not now anticipate), the proxies named on your proxy card will vote for a substitute nominee recommended by the Board of Directors.Board. Alternatively, should such circumstances arise, the Board, on the recommendation of the Nominating and Corporate Governance Committee, may decide to reduce the size of the Board and the number of nominees.

Except in a contested election, each director will be elected only if he or she receives more votes “for” than votes “against” the director nominee.. As set forth in the Company’s Corporate Governance Guidelines, any director nominee who is not elected by the vote required and who is an incumbent director must immediately tender his or her resignation to the Board for consideration. The Nominating and Corporate Governance Committee will then make a recommendation to the Board as to whether to accept or reject the tendered resignation, or whether other action is recommended. The Board will act on the tendered resignation within 90 days and will promptly disclose its decision and rationale as to whether to accept the resignation or the reasons for rejecting the resignation. If a director’s resignation is accepted by the Board, or if a nominee for director is not elected and is not an incumbent director, the Board may fill the resulting vacancy or decrease the size of the Board.

It is the responsibility of the Nominating and Corporate Governance Committee to identify, evaluate and recommend prospective director candidates for the Board, of Directors, in accordance with the policy and procedures described in the Committee’s Charter and the Company’s Corporate Governance Guidelines. The Committee regularly reviews the composition of the Board in light of the Company’s changing requirements and its assessment of the Board’s performance. The Committee seeks to include a complementary mix of individuals with diverse backgrounds and skills reflecting the broad set of challenges that the Board confronts. For more information on this process, see “Corporate Governance—Identification and Evaluation of Director Candidates.”

In assessing qualifications for nominees, the Committee expects all candidates to meet the qualifications described in the Committee’s charterCharter and the Company’s Corporate Governance Guidelines, including integrity, mature and independent judgment, diverse business experience, familiarity with the issues affecting the Company’s business, and the requisite time and ability to attend meetings and fully participate in the activities of the Board. The Committee believes that each of the nominees possesses these key attributes that are important to an effective Board. Each director nominee holds or has held senior executive positions in large organizations or government offices and has experience relevant to the Company’s business. Our directors also serve on the boards of other public and private companies and have an understanding of corporate governance practices and trends. The Committee also takes into account diversity considerations in determining the slate of directors and believes that, as a group, the nominees bring a broad range of perspectives to the boardBoard deliberations. In addition to the above, the Committee also considered the specific

experiences described in the biographical details that follow in determining to nominate the individuals set forth below for the election as directors.

The Board of Directors unanimously recommends that you vote FOR each of the nominees for director.

NOMINEES FOR DIRECTOR

Sheila C. Bair, 59 | Director since 2012 | |

| Ms. Bair is the former Chair of the Federal Deposit Insurance Corporation, where she served in that capacity from 2006 to 2011. From 2002 to 2006 she was the Dean’s Professor of Financial Regulatory Policy for the Isenberg School of Management at the University of Massachusetts-Amherst. She also served as Assistant Secretary for Financial Institutions at the U.S. Department of the Treasury (2001 to 2002), Senior Vice President for Government Relations of the New York Stock Exchange (1995 to 2000), Commissioner of the Commodity Futures Trading Commission (1991 to 1995), and as counsel to Kansas Republican Senate Majority Leader Bob Dole (1981 to 1988). She continues her work on financial policy issues as a senior advisor to the Pew Charitable Trusts and as chair of the Systemic Risk Council, a public interest group which monitors progress on the implementation of financial reforms. She is also an accomplished author and has written several books on financial issues, including educational writings on money and finance for children. She also serves on the boards of the Atlantic Council and Holton-Arms School for Girls. Qualifications: Ms. Bair has extensive expertise in banking and finance as a result of her services as Chair of the FDIC. She is also a recognized leader and author on financial policy issues. Ms. Bair also brings to the Board extensive government and regulatory experience both from her service at the FDIC as well as prior service in senior positions at the NYSE, CFTC and the U.S. Department of the Treasury. | |

Robert M. Baylis, | Director since 1996 | |

| Mr. Baylis is the retired Vice Chairman of CS First Boston. Prior to his retirement, he was Chairman and Chief Executive Officer of CS First Boston Pacific, Inc.

| |

| ||||

|

| |||

Terence C. Golden, | Director since 1995 | |

| Mr. Golden served as our President and Chief Executive Officer from 1995 until his retirement in May 2000. He is the Chairman of Bailey Capital

| |

Ann McLaughlin Korologos, | Director since 1993 | |||

| Ms. Korologos

| |

Richard E. Marriott, | Director since 1979 | |||

Chairman of the Board |

| Mr. Qualifications: Mr. Marriott has a

| |

John B. Morse, Jr., | Director since 2003 | ||

| Mr. Morse served as Vice President, Finance and Chief Financial Officer of The Washington Post Company from November 1989 until his retirement in December 2008. He also served as President of Washington Post Telecommunications, Inc. and Washington Post Productions Inc., both subsidiaries of The Washington Post Company. Prior to joining The Washington Post Company, Mr. Morse was a partner at PricewaterhouseCoopers. Mr. Morse is a Director of AES Corporation, where he is on the financial investment committee and the financial audit committee, and HSN, Inc., where he is chairman of the audit committee and a member of the compensation committee. He is also a

| ||

| Director since 2012 |

| Mr. Rakowich is the retired chief executive officer of Prologis, where he also served as a director of its board upon completion of the merger with AMB Property Corporation in 2011, and prior to that merger, as a trustee of the board since 2004. At Prologis, Mr. Rakowich served as co-chief executive officer from June 2011 to December 2012; chief executive officer from November 2008 to June 2011; president and chief operating officer from 2005 to 2008, and was a managing director and chief financial officer from 1998 to 2005. Prior to joining Prologis, Mr. Rakowich was a partner with real estate provider Trammell Crow Company, where he worked for nine years; before that he was a senior audit and tax consultant for PriceWaterhouse. Qualifications: Mr. Rakowich brings to the Board significant real estate and financial experience, including extensive knowledge of the issues facing large international real estate investment trusts. From 1998 to 2012, Mr. Rakowich served, over time, as chief financial officer, chief operating officer and chief executive officer of Prologis, a real estate investment trust focused on industrial real estate with extensive international operations. Mr. Rakowich provides valuable experience to the Board on issues facing the Company as it expands its international presence. In addition, Mr. Rakowich brings his extensive experience in accounting through his years working for PriceWaterhouse and he serves on our Audit Committee. | |

Gordon H. Smith, 60 | Director since 2009 | |

|

| |

W. Edward Walter, | Director since 2007 | |||

President and Chief Executive Officer |

| Mr. Walter is our President and Chief Executive Officer. He joined our Company in 1996 as Senior Vice President for Acquisitions, and

| |

RATIFICATION OF APPOINTMENT OF INDEPENDENT REGISTERED PUBLIC ACCOUNTANTS

The Audit Committee has unanimously approved and voted to recommend that the stockholders ratify the appointment of KPMG LLP as independent registered public accountants of the Company for 2010.2013. Representatives of KPMG LLP will be at the annual meeting and will be given the opportunity to make a statement, if they desire to do so, and to respond to questions.

The Board of Directors is asking stockholders to ratify the selection of KPMG LLP as our independent registered public accountants for 2010. Although ratification is not required by our Bylaws, the Board is submitting the selection of KPMG LLP to our stockholders for ratification as a matter of good corporate practice. If the selection is not ratified, the Audit Committee will consider whether it is appropriate to select another registered public accounting firm. Even if the selection is ratified, the Audit Committee in its discretion may select a different registered public accounting firm at any time during the year if it determines that such a change would be in the best interests of the Company and our stockholders.Company.

The Board of Directors unanimously recommends a vote FOR ratification of the appointment of KPMG LLP as independent registered public accountants of the Company for 2010.2013.

To Our Stockholders:

The Audit Committee serves as the representative of the Board of Directors of Host Hotels & Resorts, Inc. (the “Company”) for general oversight of the Company’s financial accounting and reporting, systems of internal control and audit processes. Management of the Company has responsibility for preparing the Company’s financial statements, as well as for the Company’s financial reporting process and internal controls. KPMG LLP, acting as independent registered public accountants, is responsible for performing an independent audit of the Company’s financial statements and internal control over financial reporting and for expressing an opinion on the conformity of the Company’s financial statements with U.S. generally accepted accounting principles and the effectiveness of the Company’s internal control over financial reporting. The Audit Committee is responsible for monitoring and overseeing these processes. The Audit Committee members are not professional accountants or auditors, and the Audit Committee’s functions are not intended to duplicate or certify the activities of management and the independent registered public accountants. In this context, the Audit Committee has:

reviewed and discussed with management the audited financial statements for each of the Company and Host Hotels & Resorts, L.P. for the year ended December 31, 2009,2012, including discussions of the quality, not merely the acceptability, of the Company’s accounting principles, the reasonableness of significant estimates and judgments, and the clarity of disclosure in the Company’s financial statements;

discussed with the Company’s internal and independent registered public accountants the overall scope for their respective audits and the results of their examinations, the evaluations of the Company’s internal controls and financial reporting, and the overall quality of the Company’s financial reporting;

discussed with the independent registered public accountants the matters required to be discussed by Statement on Auditing Standards No. 61,114, as amended, Communication with Audit Committees;

received the written disclosures and the letter from the independent registered public accountants required by the applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the Audit Committee concerning independence; and

discussed with KPMG LLP their independence from the Company and its management.

In reliance on the reviews, reports and discussions referred to above, the Audit Committee recommended to the Board of Directors, and the Board of Directors has approved, that the audited financial statements be included in the Company’s Annual Report on Form 10-K of the Company and Host Hotels & Resorts, L.P. for the year ended December 31, 2009.2012. The Annual Report on Form 10-K was filed with the Securities and Exchange Commission on March 1, 2010.February 25, 2013.

The Audit Committee

JohnJOHN B. Morse, Jr.MORSE, ChairJR., CHAIR

Robert M. BaylisGORDON H. SMITH

Willard W. Brittain, Jr.

Gordon H. SmithWALTER C. RAKOWICH

Principal Accountant Fees and Services

The Company was billed the following amounts for professional services by KPMG LLP, its independent registered public accountants, for 20092012 and 2008:2011:

| 2009 | 2008 | 2012 | 2011 | |||||||||||

Audit fees (annual financial statements, review of quarterly financial statements and audit of internal controls over financial reporting) | $ | 3,140,000 | $ | 2,036,949 | $ | 3,832,000 | $ | 3,578,000 | ||||||

Audit-related fees (1) | 228,000 | 125,654 | 17,000 | 19,000 | ||||||||||

Tax fees (2) | — | 25,234 | ||||||||||||

All other fees | — | — | — | — | ||||||||||

|

| |||||||||||||

Total Fees | $ | 3,368,000 | $ | 2,187,837 | $ | 3,849,000 | $ | 3,597,000 | ||||||

|

| |||||||||||||

| (1) | Audit-related fees consisted |

The Audit Committee concluded that the provision of these audit-related and tax services is compatible with maintaining the independence of KPMG LLP. The Company does not engage KPMG LLP for any tax services unrelated to audit services.

Pre-Approval Policy for Services of Independent Registered Public Accountants

All services performed by KPMG LLP were pre-approved by the Audit Committee in accordance with its 20092012 pre-approval policy. The policy describes the audit, audit-related, tax and other services permitted to be performed by the independent registered public accountants, subject to the Audit Committee’s prior approval of the services and fees. On an annual basis, the Audit Committee will review and provide pre-approval for certain types of services that may be provided by the independent registered public accountants without obtaining specific pre-approval from the Audit Committee. The Audit Committee has pre-approved certain services (and corresponding cost levels) in conjunction with Committee meetings, typically conducted in February of each year. If a type of service to be provided has not received pre-approval during this annual process, it will require specific pre-approval by the Audit Committee. Any proposed services exceeding pre-approved cost levels or budgeted amounts will also require separate pre-approval by the Committee.

The Audit Committee has designated the Senior Vice President, Corporate Controller to monitor the performance of all services provided by the independent registered public accountants and to determine whether such services are in compliance with the pre-approval policy.

Policy for Hiring Members of the Audit Engagement Team

The Audit Committee adopted a policy regarding the hiring of audit engagement team members to address the potential for impairment of auditor independence when partners and